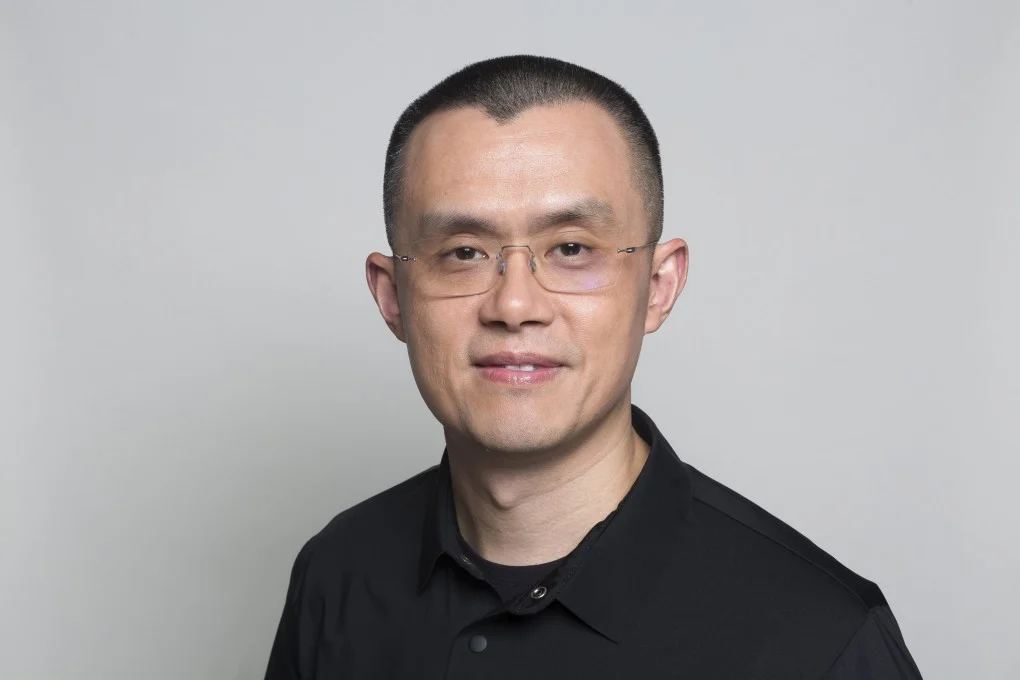

Binance’s CZ calls Trump connection claims a misunderstanding at Davos

Investors are embracing risk at a level not seen in five years, according to new data from Goldman Sachs, even as geopolitical tensions persist globally. The bank's proprietary risk appetite indicator climbed to 1.09 last week, marking its highest reading since 2021 and placing it in the 98th percentile historically.

The surge in the indicator, which tracks a spectrum of market behaviors, reflects a pronounced shift toward riskier assets. Goldman strategists noted that while such elevated levels are rare—occurring only six other times since 1991—they do not necessarily signal an imminent market correction. "Equity returns can be sustained by a supportive macro backdrop," the bank stated in its analysis.

Small Caps and Emerging Markets Lead Charge

The most pronounced movement is toward small-capitalization stocks. The Russell 2000 index has surged 7.5% year-to-date, outpacing the S&P 500 by more than 830 basis points in the first 15 trading sessions of 2026—a performance one strategist termed "incredible." The rally is underpinned by expectations for robust earnings growth of 30-35% for small caps, compared to an estimated 22% for the "Magnificent 7" tech giants, and by the beneficial impact of anticipated Federal Reserve rate cuts on their floating-rate debt.

Concurrently, a rotation away from large-cap technology is evident. Recent data shows $900 million in outflows from tech sector funds, while $8.3 billion flowed into industries like materials, health care, and industrials. Emerging market equities have also attracted significant capital, with some indexes posting their longest winning streaks in decades.

Gold as the Conspicuous Hedge

Amid this broad risk-on sentiment, gold stands out as a key contrarian signal. The precious metal, which has more than doubled in price over two years, continues to attract safe-haven demand due to political risks and as an alternative to traditional currencies and bonds. Goldman strategists noted that excluding gold from their risk calculation would have pushed their indicator even higher.

The bank maintains an overweight stance on equities, citing a supportive economic environment. This collective behavior marks a distinct shift in investor psychology, where optimism over economic growth and corporate earnings is currently outweighing geopolitical concerns.

Bottom Line

The data underscores a market defined by aggressive sector rotation and a rising tolerance for risk. The sustainability of this trend hinges on the continued performance of the economy and corporate earnings in the coming months. For now, capital is decisively flowing toward smaller companies, cyclical sectors, and emerging markets.