Healthcare is not one trade in today's stock market premarket analysis

The U.S. equity market is exhibiting pronounced sector rotation as the trading session begins, with capital aggressively shifting away from regulatory-pressured industries toward growth-oriented and cyclical segments. This movement underscores a selective, rather than broadly bearish, market environment.

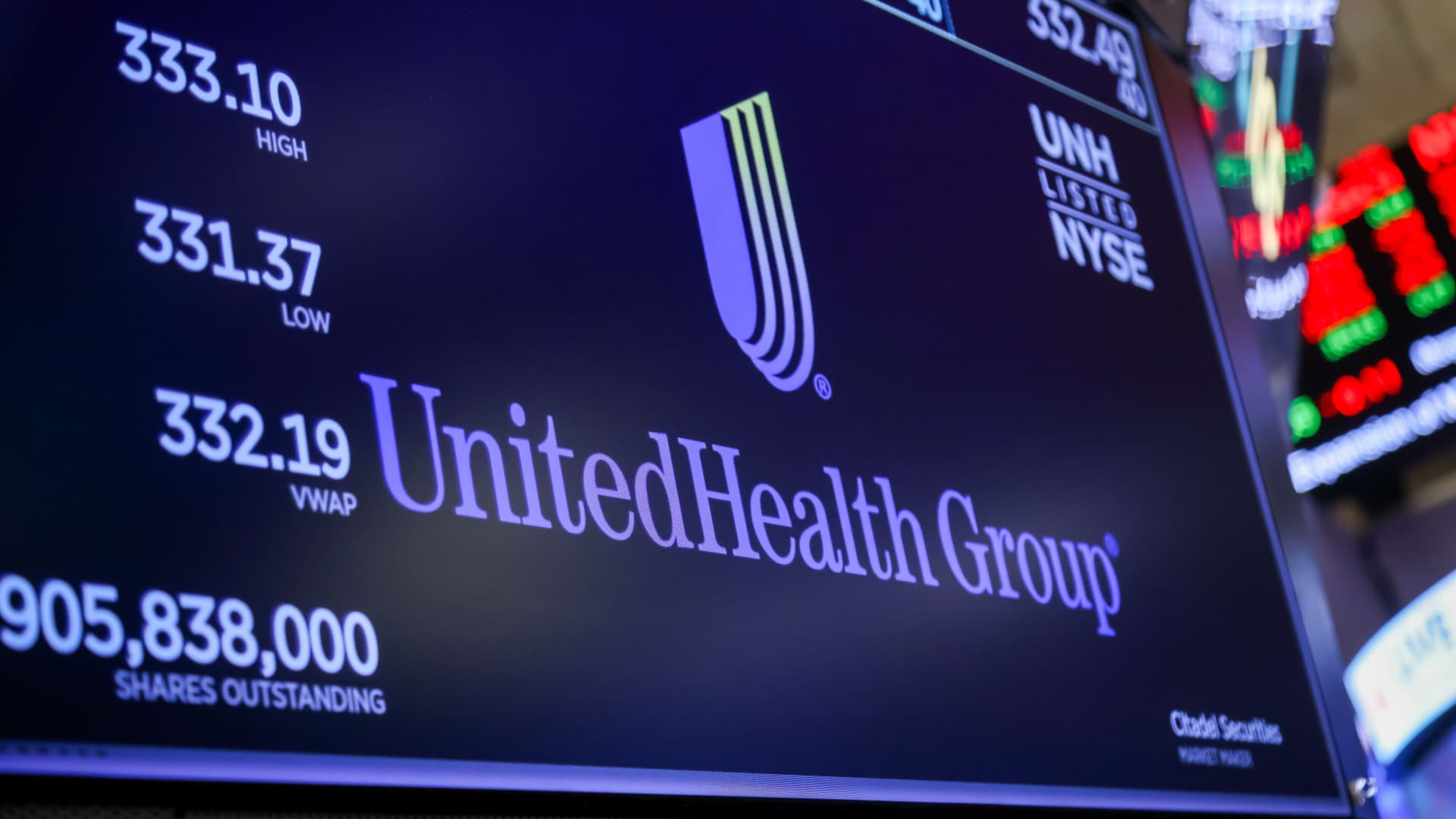

Healthcare Sector Sees Dramatic Split

A stark intra-sector divide is unfolding in healthcare. Managed care insurers are under severe pressure following a regulatory proposal that set 2027 Medicare Advantage payment rates far below expectations, triggering a margin and valuation reset.

Insurers Down Sharply: UnitedHealth Group and CVS Health are down approximately 16% and 13% in premarket trading, respectively.

Providers Rally: In contrast, hospital operators like HCA Healthcare are surging, up nearly 8% after strong earnings, highlighting their relative insulation from the reimbursement news.

Technology and Semiconductors Absorb Liquidity

As capital exits certain healthcare subsectors, it is finding a destination in technology, particularly semiconductors. This rotation is helping to stabilize broader indices.

Chipmakers Gain: Intel and Micron Technology are up over 3% and 4% premarket, respectively, on heavy volume, with Nvidia holding firm.

Growth-Cyclical Hybrid: Semiconductors' position at the intersection of growth and cyclicality makes them a natural beneficiary of rotation out of defensive and regulated names.

Broader Rotation Trends Align with January Data

This day's action fits a broader January pattern of institutional repositioning:

Cyclicals in Favor: Industrials and Financials are attracting flows, supported by narratives of stable infrastructure investment and a shifting interest rate outlook.

Selective Growth Trimming: While some crowded growth trades are being pared back, technology is seeing inflows, indicating a rotation within the sector rather than a wholesale exit.

Investor Takeaways: Selectivity Over Sentiment

The current market emphasizes precision over broad strokes. Key insights for investors and traders include:

Understand Sector Composition: Recognizing that sectors like healthcare contain vastly different business models (payers vs. providers) is crucial for interpreting news flow.

Monitor ETF Flows: Movements in sector-specific Exchange-Traded Funds (ETFs) are a powerful signal of institutional capital reallocation.

Assess Rotation Phase: Current moves in hospitals, semiconductors, and cyclicals appear early- to mid-stage, but chasing extended gaps higher increases risk.

Session Catalysts to Watch

Market health will depend on whether new leadership holds. Key monitors for the day include:

Stabilization of selling pressure in health insurers.

Sustainability of gains in hospital stocks and semiconductor strength.

Follow-through volume in Industrial and Financial ETFs.

The bottom line: This is a rotation-driven market. Success hinges on identifying where capital is flowing to, not just where it is fleeing from.