Bitcoin Starts Week on Shaky Ground as Uncertainty Lingers

Suvashree Ghosh and Emily Nicolle Mon, January 26, 2026 at 7:15 PM GMT+8 2 min read

In this article: GC=F

BTC-USD

ETH-USD

DX-Y.NYB

(Bloomberg) -- Bitcoin staged a minor recovery after a sharp fall Sunday, starting the week on shaky ground as global geopolitical tensions prompted a move away from risk assets and into safe havens such as gold.

The largest cryptocurrency dropped as much as 3.5% on Sunday to a 2026 low of just above $86,000, before paring some of those losses. It hovered around $87,883 as of 6:15 a.m. in New York on Monday, a rise of about 1.6% in the last 24 hours. Ether slumped as much as 5.7% before rallying, still close to its lowest level since mid-December.

Most Read from Bloomberg

White House Ballroom Architect Reveals New Trump-Requested Features

NYC’s Mamdani Crushes Snow Day Hopes, But He Yearns for It Too

Boston’s 18-Inch Snow Deluge to Make Travel Hard to ‘Impossible’

NYC Bans Hidden Hotel Fees Ahead of World Cup Tourist Influx

World Cup Cities Set to Win $100 Million in Federal Transit Aid

“Despite the more constructive set up, BTC is still struggling against a macro environment that has favored gold and other commodities,” said Martin Gaspar, senior crypto market analyst at FalconX.

The dollar hit a four-month low on Monday, falling for a third consecutive day. Gold advanced beyond $5,000 an ounce for the first time.

Bitcoin is often positioned as a digital alternative to gold, promoted by believers as an inflationary hedge and alternative to the precious metal. Some countries, like El Salvador and Venezuela, have amassed large stockpiles of the token.

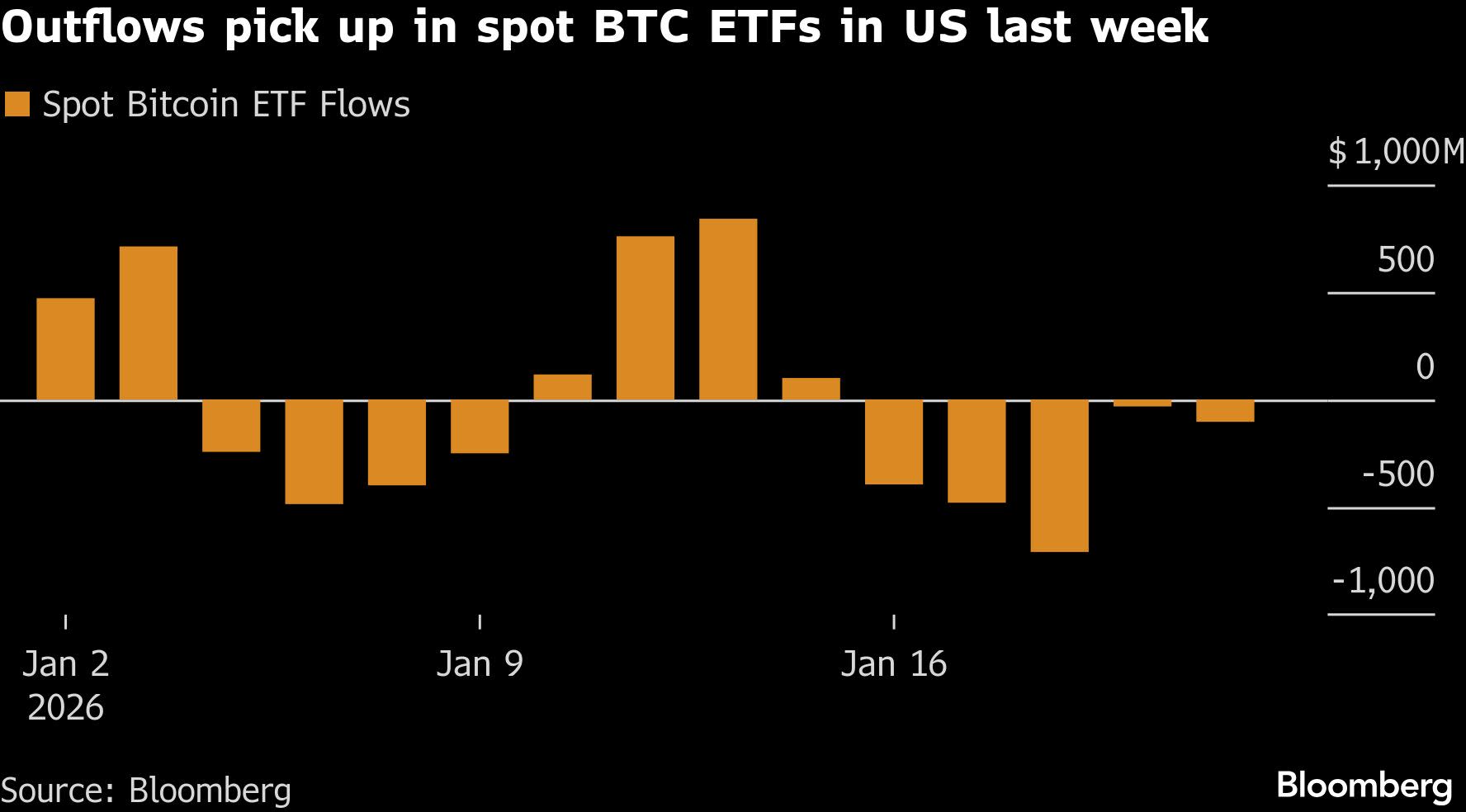

Exchange-traded funds tracking the spot price of Bitcoin saw five consecutive days of outflows totaling $1.7 billion last week in the US, almost wiping out the previous four days of inflows, according to data compiled by Bloomberg.

Geopolitical concerns such as President Donald Trump’s threat of 100% tariffs on imports from Canada, reports of a large fleet of US warships heading toward Iran and rising odds of another US government shutdown are weighing on overall market sentiment, according to Tony Sycamore, analyst at IG Australia.

Traders also began the week on heightened alert for a Japanese intervention in the market following the yen’s recent slide, and with news of China’s biggest military purge in roughly half a century.

Looking ahead, eyes will be on Wednesday’s interest rate decision from the Fed and press conference, according to Simon Peters, crypto analyst at eToro. “With inflation in the US still above target and not on a downward trajectory, expectations are for the Fed to hold rates at current levels, but traders and investors will be looking for fresh insight into if the Fed sees inflation coming down and potential cuts later on this year,” he said in a note Monday.

Most Read from Bloomberg Businessweek

The US Is Losing Top Tech Talent to India in the Wake of Trump’s H-1B Chaos

Canadians Are Boycotting US Ski Slopes

An Un-MAGA Proposal to Bring Back American Manufacturing

What, If Anything, Is Behind Trump’s Greenland Dream?

Industry TV Recap: Short and Tender

©2026 Bloomberg L.P.