One year on from the UK’s grand AI plan: Has its infrastructure buildout been a success?

Nearly a year after Prime Minister Keir Starmer unveiled plans to make the U.K. an "AI superpower," the country’s ambitious AI infrastructure rollout is encountering significant headwinds, chiefly due to constrained energy grid capacity and slow construction progress. While tech giants like Nvidia, Microsoft, and Google have pledged billions in investment, critics warn that "ambition and delivery are not yet aligned."

Grid Delays Threaten Timelines

The centerpiece of the strategy—"AI growth zones" with relaxed planning rules—has seen limited tangible progress. Of the four zones announced, only one has begun ground preparation, with full construction not expected until early 2026. The most critical obstacle is grid access: developers report connection delays of 8 to 10 years, with an unprecedented backlog of requests, especially around London.

"Grid bottlenecks have slowed the pace of development," said Ben Pritchard, CEO of power supplier AVK. AI workloads are "dramatically increasing energy demand," exacerbating pressure on a system already struggling with Europe’s highest energy costs. The National Energy System Operator recently moved to prioritize hundreds of projects for faster grid access, including data centers, but whether AI projects will benefit remains unclear.

Investment Momentum vs. Execution Risk

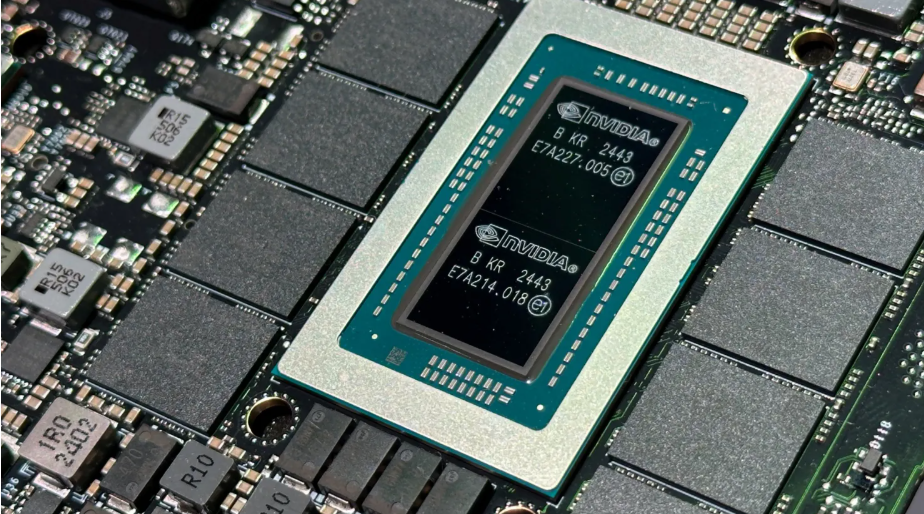

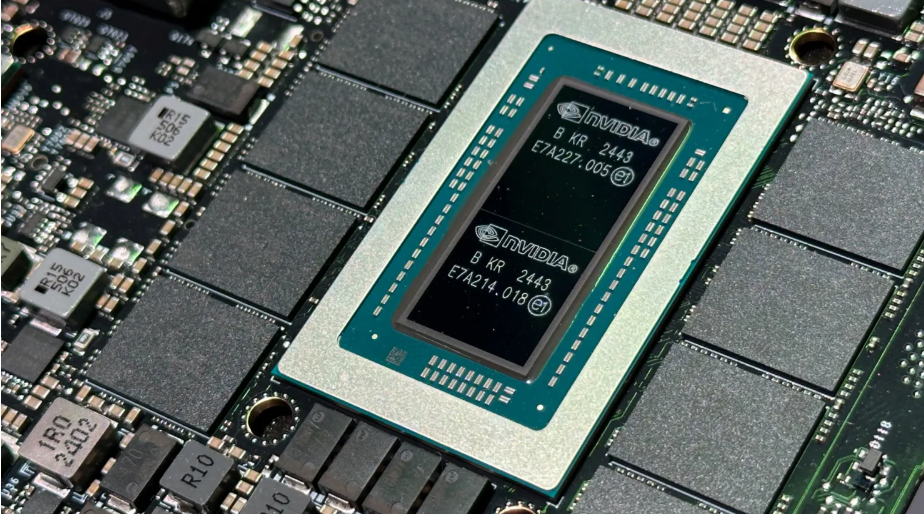

High-profile commitments during President Trump’s state visit—including multi-billion-dollar plans from Microsoft, Nvidia, and CoreWeave—have laid important groundwork. Homegrown startup Nscale also announced deals to deploy tens of thousands of Nvidia chips near London by 2027. However, the "real test," as NetApp’s Puneet Gupta noted, is how quickly these plans translate into usable compute for U.K. organizations.

Building Beyond a "Sugar Rush"

Long-term success requires investing in the full stack: data pipelines, storage, security, and talent. "If the U.K. wants this to be durable rather than a one-year sugar rush, it has to treat AI infrastructure like economic infrastructure," said Stuart Abbott of VAST Data. Solutions like microgrids—self-contained power networks—are being explored but come at a ~10% cost premium and multi-year build times.

Co-locating compute near existing power sources, rather than relying solely on greenfield sites, could accelerate deployment. Yet as Kao Data’s Spencer Lamb warned, unless fundamental issues around energy, copyright, and funding are resolved quickly, the U.K. "risks becoming an international AI backwater."

The coming year will be decisive in determining whether the U.K. can transform bold rhetoric into a competitive AI ecosystem—or whether grid constraints and execution delays will leave it lagging in the global race for AI supremacy.