Versant Media Group Debuts as Public Company Amid Shifting Media Landscape

Versant Media Group, the portfolio of cable networks and digital assets spun off from Comcast, began public trading on the Nasdaq Monday under the ticker "VSNT." The debut adds a new, if somewhat unconventional, player to the small cohort of publicly traded traditional media companies at a time when the industry is grappling with profound disruption from cord-cutting and streaming competition.

The stock opened at $45.17 but closed its first day at $40.57, down 13%. The company, with a market valuation of roughly $6.5 billion, was distributed to Comcast shareholders at a ratio of one Versant share for every 25 Comcast shares owned.

A Strategy Focused on News, Sports, and Digital Pivot

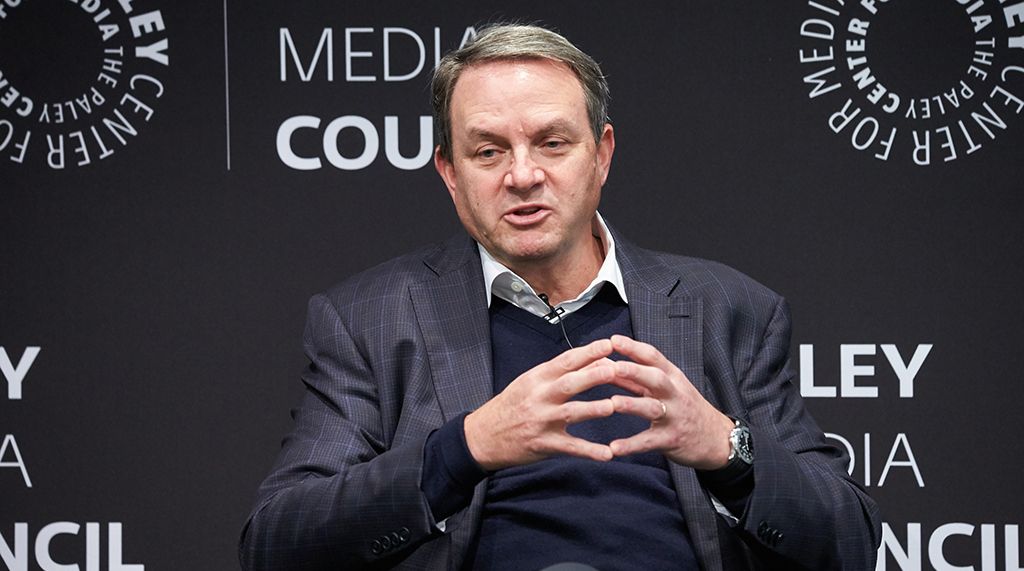

Versant's portfolio includes major cable brands like CNBC, MSNBC, USA Network, and digital properties such as Fandango and Rotten Tomatoes. CEO Mark Lazarus, in a media appearance, emphasized the company's strategic independence and focus. "Now we're bringing these [assets] into their own company, we're going to be able to invest into them," he stated, highlighting plans for organic growth and potential acquisitions to build its digital presence.

A key pillar of Versant's investment thesis is its concentration in news and sports programming, which together account for 62% of its portfolio. These genres continue to draw live viewers and advertising dollars despite the broader decline of the linear TV bundle. The company also enters the market with a relatively conservative debt structure, a point favorably noted by ratings agencies, especially compared to heavily leveraged peers.

Navigating Industry Headwinds and Financial Reality

The spinoff itself is a direct response to the challenging media environment. Versant's recent financials reveal the pressures: revenue has declined from $7.8 billion in 2022 to $7.1 billion in 2024, with net income following a similar downward trend. While still profitable, the core business faces the secular decline of cable subscriptions.

Analysts and ratings agencies acknowledge these headwinds but point to the company's strong brand portfolio in resilient categories and its manageable debt as stabilizing factors. The success of Versant's public market journey will largely depend on executing its stated strategy—diversifying revenue by accelerating digital growth while managing the decline of its legacy linear TV business.