Gold hits record as Trump tariff threat over Greenland spurs safe haven demand

Pedro Goncalves · Finance Reporter, Yahoo Finance UK Mon 19 January 2026 at 5:37 pm GMT+8 4 min read

In this article: GC=F

^FTSE

DX-Y.NYB

^GSPC

^DJI

Gold (GC=F)

Gold prices climbed to fresh peaks on Monday morning as investors sought refuge in safe haven assets after US president Donald Trump threatened to impose additional tariffs on European countries in a dispute over Greenland.

Gold futures (GC=F) rose 1.8% to $4,677.30 an ounce, while spot prices gained 1.6% to $4,668.75 at the time of writing. Prices touched an all-time high of $4,689.39 earlier in the session.

The rally followed comments by Trump over the weekend in which he vowed to impose a wave of escalating tariffs on European allies unless the US is allowed to buy Greenland, intensifying a long-running row over the future of Denmark’s vast Arctic island.

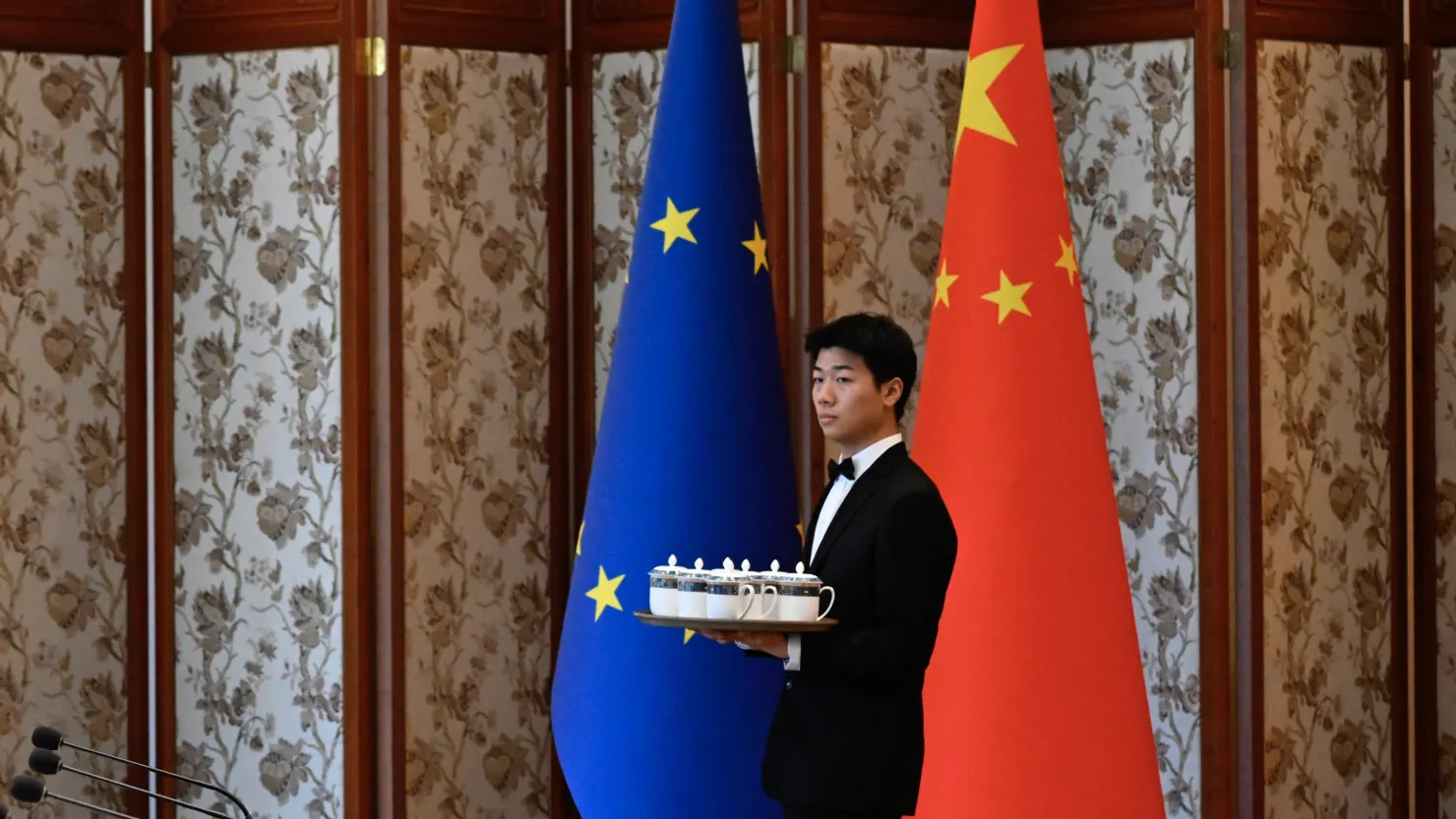

European Union ambassadors are preparing retaliatory measures should the duties be imposed, according to EU diplomats.

“Geopolitical tensions have given gold bulls yet another reason to push the yellow metal to new highs,” said Matt Simpson, senior analyst at StoneX.

Read more: Markets dip as Trump flexes tariff threat and EU prepares €93bn response

“With Trump throwing tariffs into the mix, it is clear that his threat to Greenland is real, and that we could be one step closer to the end of NATO and political imbalances within Europe,” he added.

Precious metals are typically seen as safer assets during periods of heightened uncertainty, and both gold (GC=F) and silver prices have surged over the past year. Gold rose by more than 60% last year, driven in part by concerns over global tensions and economic uncertainty.

Oil prices edged lower on Monday morning after reports that Trump had halted plans for a potential military strike on Iran, easing concerns about supply disruptions from the Middle East.

Brent crude futures (BZ=F) fell 0.5% to $63.81 a barrel, while West Texas Intermediate (CL=F) slipped 0.5% to $59.07 at the time of writing.

Axios reported on Sunday that Trump had aborted planned military action against Iran following diplomatic progress, logistical obstacles and strong opposition from key regional allies.

“It was really close. The military was in a position to do something really fast,” a US official told the outlet, describing the intensity of the situation.

Officials in Washington and several Middle East capitals had expected an imminent operation after a meeting on Tuesday, but no order was issued. Trump had initially narrowed the range of military options against Iranian targets before hesitating as complications emerged.

Read more: What will happen to Venezuela's bitcoin stash after Maduro's capture?

One factor behind the reversal was the redeployment of US military assets towards the Caribbean and Asia, which left forces in the Middle East insufficiently prepared. Officials said that “the theatre was not ready,” limiting the options available.

"The pullback followed a swift unwind of the 'Iran premium' that had driven prices to 12-week highs, triggered by signs of easing in Iran's crackdown on protesters," IG market analyst Tony Sycamore said in a note.

The developments reduced market anxiety over possible supply disruptions from Iran, putting downward pressure on oil (BZ=F, CL=F) prices.

Investors are also watching developments in Venezuela’s oil industry after Washington said it would take control of the country’s oil sector.

US energy secretary Chris Wright told Reuters that the administration was moving as quickly as possible to grant Chevron (CVX) an expanded licence to produce oil in Venezuela.

But markets were less confident about the prospects for scaled-up Venezuelan production.

"Venezuela and Ukraine remain on the back burner," said Vandana Hari, founder of oil market analysis provider Vanda Insights. "Expect rangebound movement for the rest of the day, with US markets closed," she added.

US markets are closed on Monday for Martin Luther King Jr. Day.

Sterling edged higher against the dollar in early European trading as the US currency weakened following fresh tariff threats from Trump linked to Greenland.

The pound rose 0.2% against the dollar to $1.3396 but was muted versus the euro at €1.1522.

The US dollar index (DX-Y.NYB), which measures the greenback against a basket of six major currencies, was down 0.2% to 99.22.

The prospect of an escalating trade dispute weighed on the dollar as investors assessed the longer term implications of the move for the currency’s standing.

Stocks: Create your watchlist and portfolio

“While you would argue that the tariffs threaten Europe, in fact, it’s actually the dollar that is bearing the brunt of it, because I think markets are pricing in increased political risk premia on the US dollar,” said Khoon Goh, head of Asia research at ANZ.

Traders are now turning their attention to UK employment figures and consumer price index data due later this week, which could offer clues about the Bank of England’s monetary policy outlook. Analysts said weaker than expected data could put renewed pressure on sterling against the dollar in the near term.

In equities, the FTSE 100 (^FTSE) on Monday was down 0.1%, trading at 10,224 points. For more details on market movements, check our live coverage here.

UK housing market rebounds after budget as average price jumps 2.8%

Hamptons reports fall in rents in 2025 for first time on record

Bank of England's Andrew Bailey says weak growth risks financial instability

Download the Yahoo Finance app, available for Apple and Android.