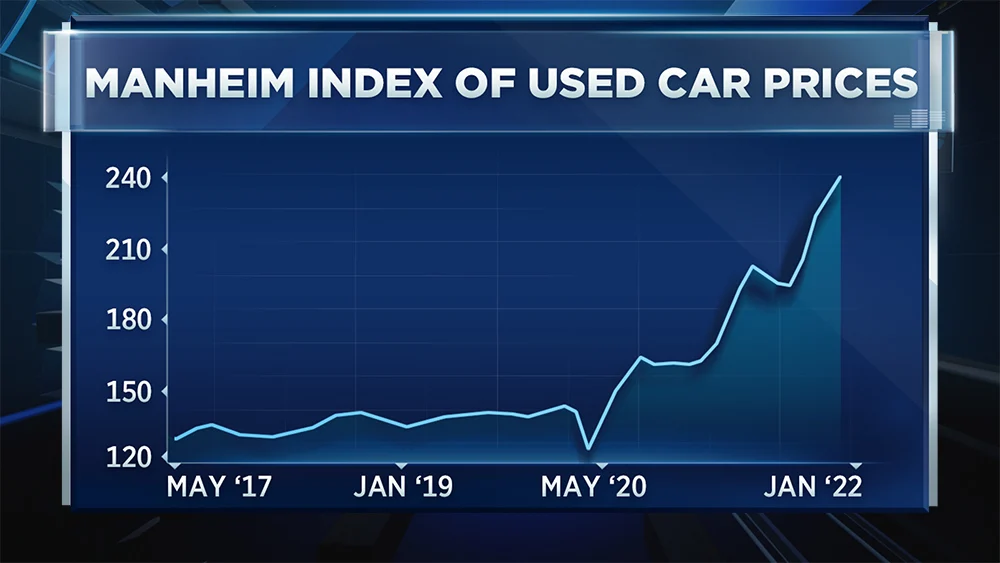

‘Bubblicious’ used car prices are rising faster than bitcoin, market researcher Jim Bianco warns

Used Car Prices Outpace Bitcoin and Stocks, Sparking "Bubblicious" Inflation Concerns

New York — In a striking sign of pandemic-era market distortions, used automobiles have emerged as one of 2025's hottest appreciating assets, outperforming major stocks and even cryptocurrencies over recent months, according to market analyst Jim Bianco.

"If you want to know what the best investment you probably had... it's that car sitting in your driveway," the Bianco Research President told CNBC. He pointed to the Manheim Used Vehicle Index, which has surged over 20% in the past four months alone—a rate that eclipses the gains of both the S&P 500 and Bitcoin during the same period.

A Perfect Storm of Scarcity and Speculation

Two primary forces are fueling the unprecedented rally. First, a persistent global semiconductor shortage has crippled new car production, pushing legions of buyers into the used market and creating severe supply scarcity. Second, the price surge has attracted speculators looking to flip vehicles for a quick profit, a dynamic Bianco describes as a self-reinforcing cycle: "Buy it now because it’s only going to get more expensive."

The data is stark: the average used car price hit $27,569 in November, a 27% year-over-year increase. "Used car prices are supposed to be a depreciating asset. They’re not supposed to go up in price," Bianco noted. "It has all the tell-tale signs of a bubble."

A Macroeconomic Warning Signal

Beyond the auto market, Bianco interprets the frenzy as a critical indicator of broader inflationary pressures—exactly the kind the Federal Reserve aims to suppress. "This is that self-reinforcing idea about inflation," he warned. The situation presents a complex challenge for policymakers trying to engineer a soft landing for the economy, as asset bubbles in essential goods like transportation can have widespread ripple effects.

While Bianco expects inflation to moderate, he cautions that the decline will be "a lot slower than most people think." The used car market's peak remains highly unpredictable: "This could go on for another year. It could go on for two more weeks. The activity that you’re seeing is probably bubblicious."

A Symptom of Distorted Markets

The phenomenon underscores how supply chain disruptions and excess liquidity can create violent strategic pivots in the value of everyday assets. For consumers, it turns a typical depreciating purchase into a volatile store of value. For investors and economists, it serves as a real-time case study in bubble psychology and a warning about the fragile, interconnected nature of post-pandemic competitive ecosystems.

The used car boom is more than a quirky market anomaly; it's a vivid snapshot of an economy where traditional rules of depreciation are suspended, speculation runs hot, and the line between a consumable good and an investable asset becomes dangerously blurred.