Home prices are getting slightly more affordable, but down payments are still holding buyers back

New York — The U.S. housing market is displaying tentative signs of improved affordability as a combination of moderating prices, declining mortgage rates, and increased inventory begins to shift the math for potential buyers. However, the path to homeownership remains steep, with saving for a down payment continuing to be the most significant barrier for first-time purchasers.

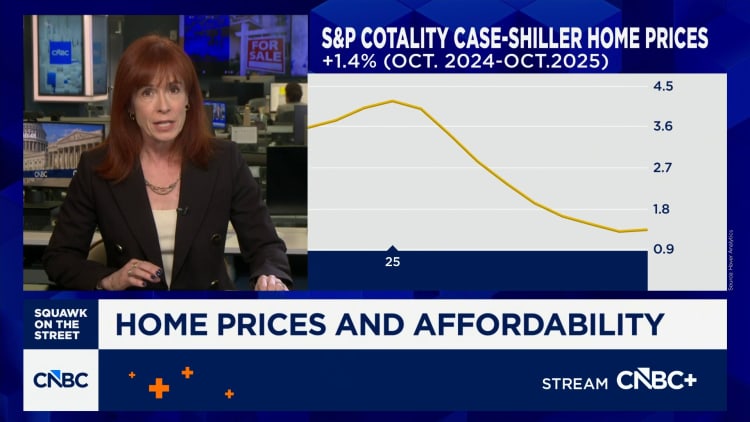

Nationally, home prices are essentially flat compared to a year ago, with some major markets like Tampa, Phoenix, and Dallas even seeing declines. Concurrently, the average rate on a 30-year fixed mortgage has fallen from over 7% at the start of the year to approximately 6.19%, creating tangible monthly savings. For a typical buyer, this strategic pivot in the market's fundamentals means the monthly payment on a median-priced home is now about $200 less than it was a year ago.

A Market of Contrasts: Geographic Divergence and the Saving Challenge

Beneath the national trend lies significant geographic variation. While cities like Chicago and New York post gains, others face softer prices. Despite the overall affordability improvement, the core challenge persists: saving for a down payment. Realtor.com data indicates it now takes the typical buyer seven years to save—a marked improvement from the 12-year peak in 2022 but still far longer than pre-pandemic norms, partly due to lower personal savings rates.

This dynamic helps explain why the U.S. homeownership rate has dipped to 65%, its lowest since 2019. The market is experiencing a competitive ecosystem where improved conditions are attracting more buyers—pending home sales in November hit a nearly three-year high—yet the initial capital hurdle continues to sideline many, particularly first-timers.

Increased Inventory Fuels Cautious Optimism

A critical factor adding momentum is the growth in housing supply. Active listings are currently about 12% higher than a year ago, offering buyers more choices and reducing the frenzy that characterized recent years. This increased selection, combined with wage growth now outpacing home price appreciation, is creating a more balanced environment.

“Improving housing affordability... is helping buyers test the market,” said Lawrence Yun, chief economist for the National Association of Realtors. The current landscape suggests the market is navigating a complex high-stakes race between pent-up demand and financial feasibility. While the strategic maneuver of entering the market has become less daunting monthly, the foundational challenge of accumulating a down payment ensures the recovery in buyer activity will be measured and uneven.